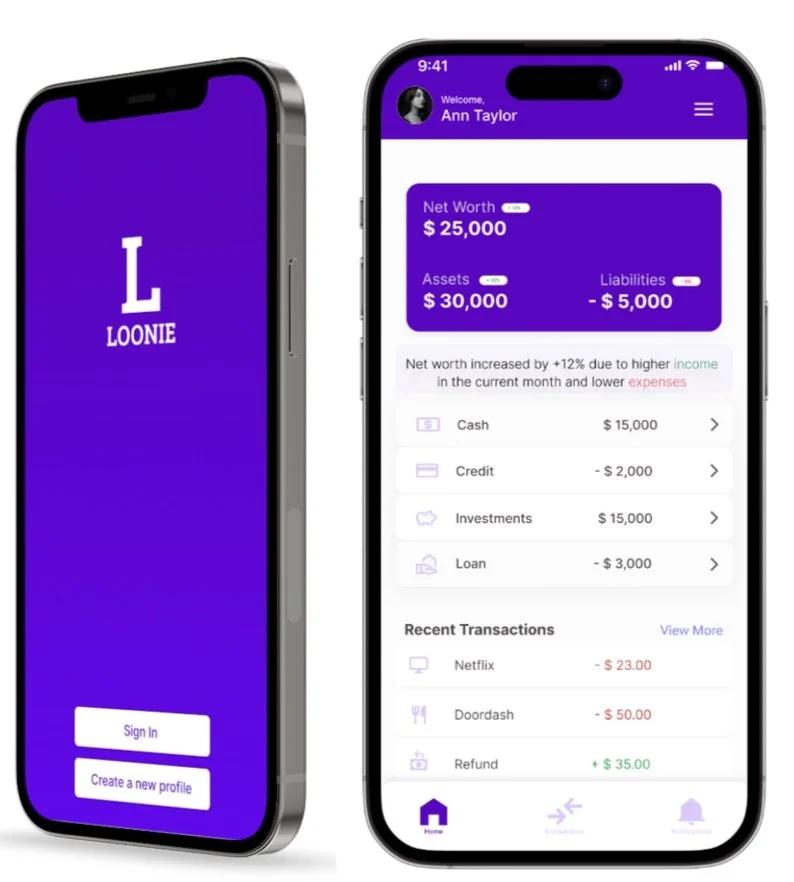

LOONIE

a family finance management app

The Product

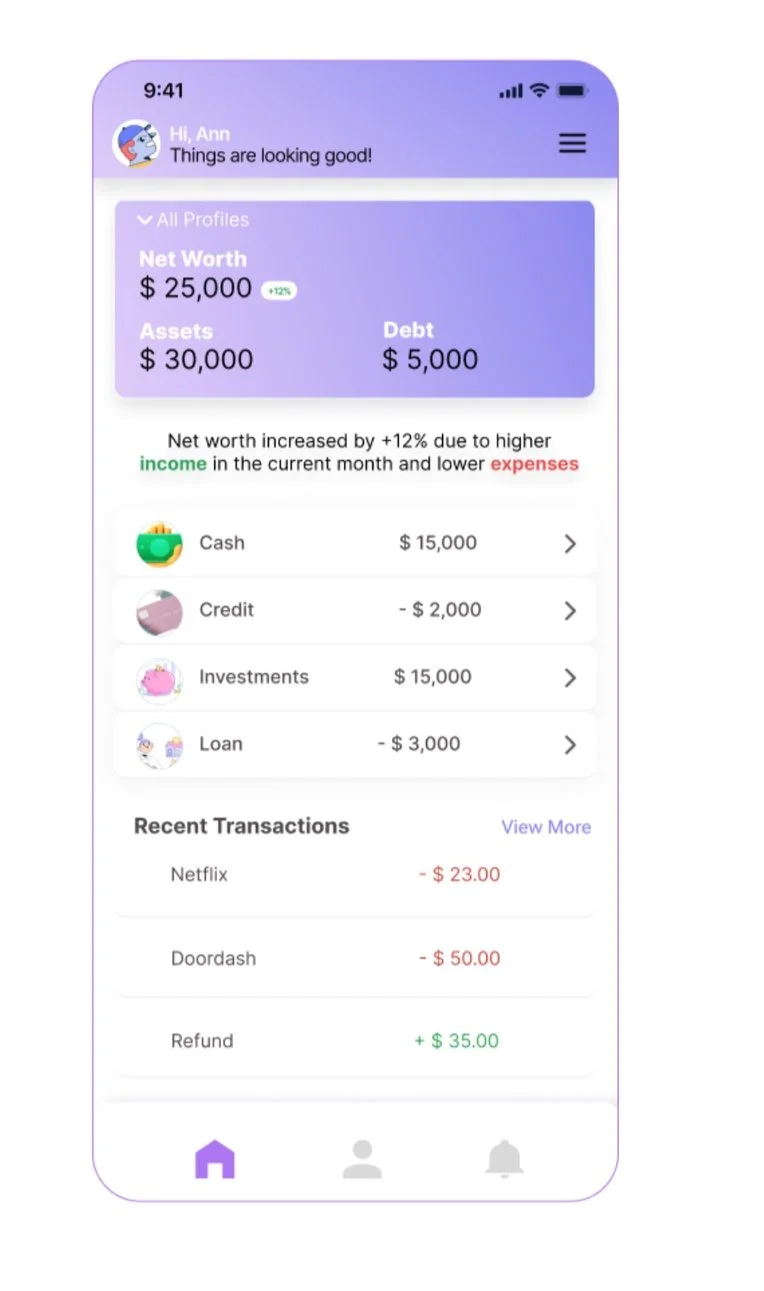

Loonie is the ultimate personal financial management app targeted towards the Canadian and US market.

Seamlessly integrating all financial aspects into one secure and user-friendly mobile platform, Loonie offers comprehensive solutions for budgeting, investment tracking, and valuable financial insights, putting control of finances directly into the hands of our users.

Project Duration

7 months

October 2023 - ongoing

Cross Functional Partners

Founder/Product Manager

Engineering Lead

My Role

Lead UX Designer

User interviews, Surveys

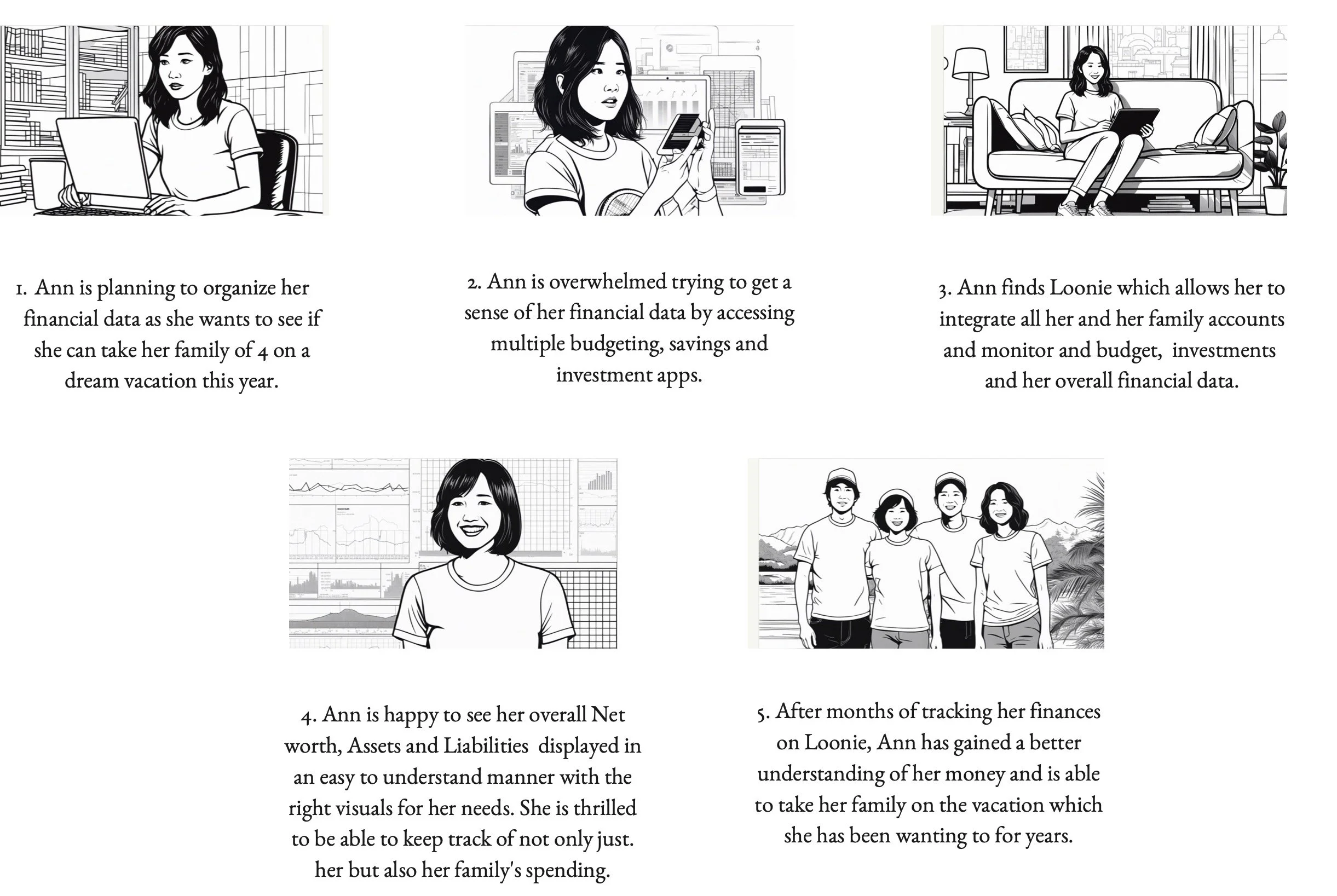

Storyboarding

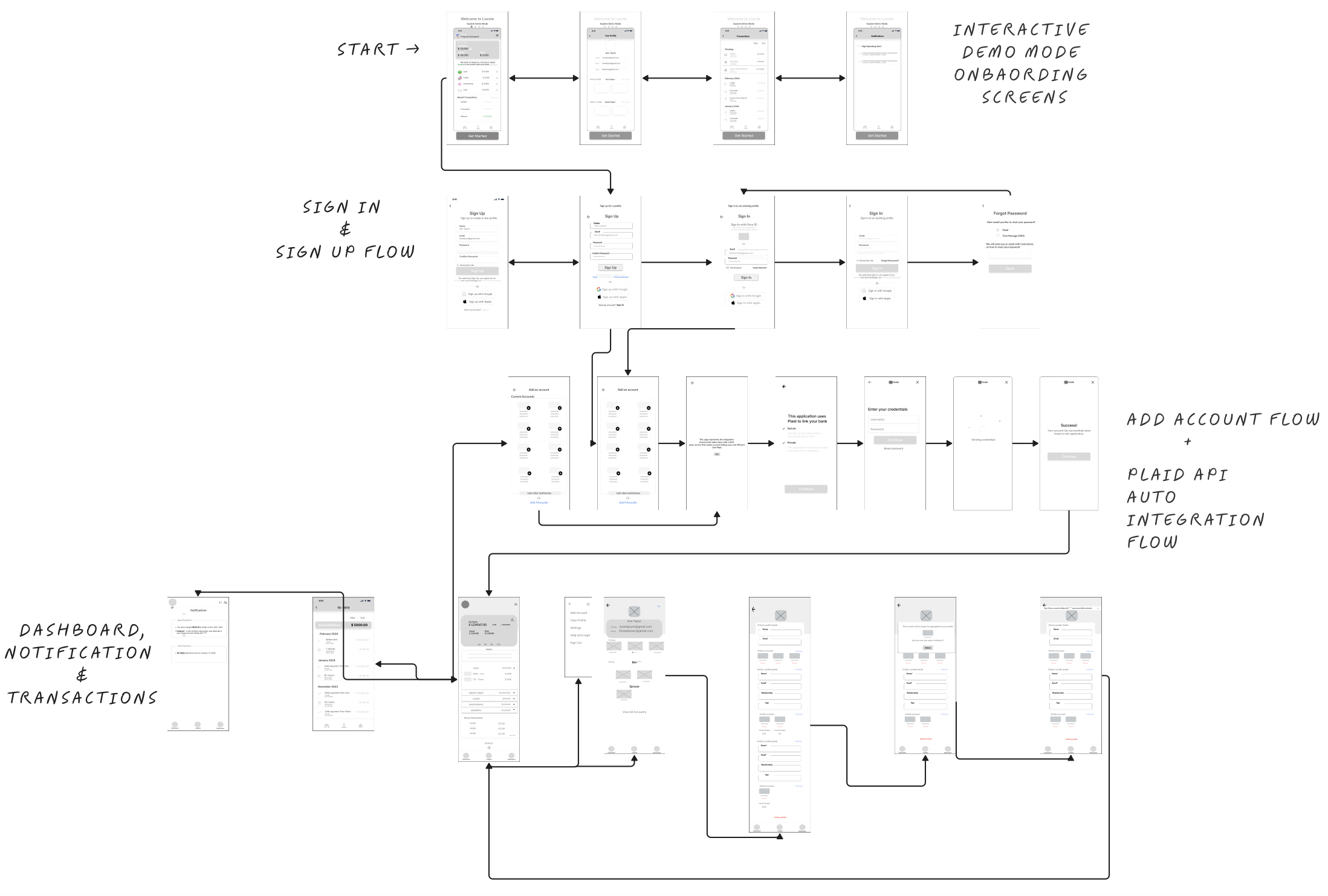

Paper and digital wire-framing

Low and high-fidelity prototyping

User research

Usability studies

Accessibility considerations

Design Iterations

Tools

Figma - designs

Miro Design - personas & empathy maps

Lucidchart - diagrams

AI Boords - storyboarding

Summary

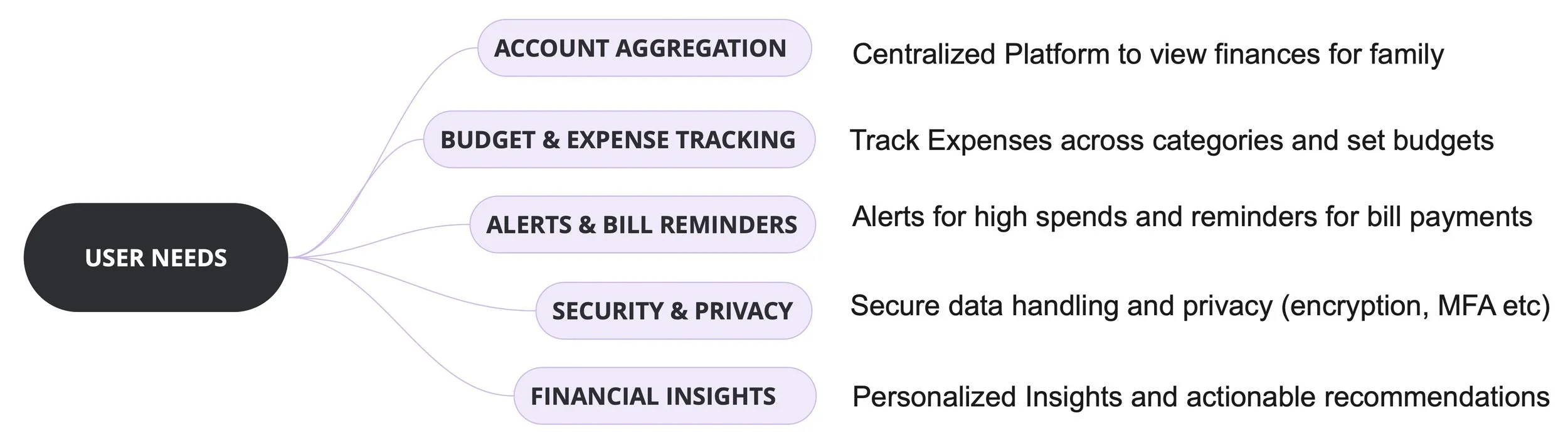

We wanted to create a product that solves for the common challenges faced by users in managing finances, such as budgeting, expense and investment tracking in the form of an intuitive and centralized application.

Throughout the design process, I focused on understanding the unique needs of Canadian users through extensive research and user testing. This user-centered approach guided the creation of Loonie's integrated platform, which seamlessly combines all financial aspects into one secure and user-friendly interface.

From initial ideation to prototyping and testing, my portfolio showcases the iterative design process employed to ensure that Loonie meets the diverse needs of its users. By empowering Canadians to take control of their financial health and achieve their long-term goals, Loonie represents the culmination of my dedication to creating impactful and user-centric design solutions.

This is an ongoing project going out on 4 phases. Phase 1 is to be launched in April 2024.

Before I started the designs I wanted to understand a few things

THE PROBLEM

Many Canadians lack a comprehensive, affordable and user-friendly tool to manage all of their personal finances.

This includes challenges in budgeting, tracking expenses, managing investments, and understanding financial health.

THE USERS

The primary users are Canadian residents who are looking for efficient ways to manage their personal finances. This includes individuals who are budget-conscious, those managing multiple bank accounts and investment portfolios, and users who value financial planning and security.

THE OPPORTUNITY

The opportunity lies in creating an inexpensive integrated solution that addresses these needs in a single, accessible platform.

CURRENT SOLUTIONS

Currently, customers may use a combination of methods including:

traditional banking apps,

spreadsheets,

standalone budgeting tools, and

manual tracking.

However, these methods can be fragmented, not user-friendly, or lack comprehensive features like investment tracking and personalized financial advice.

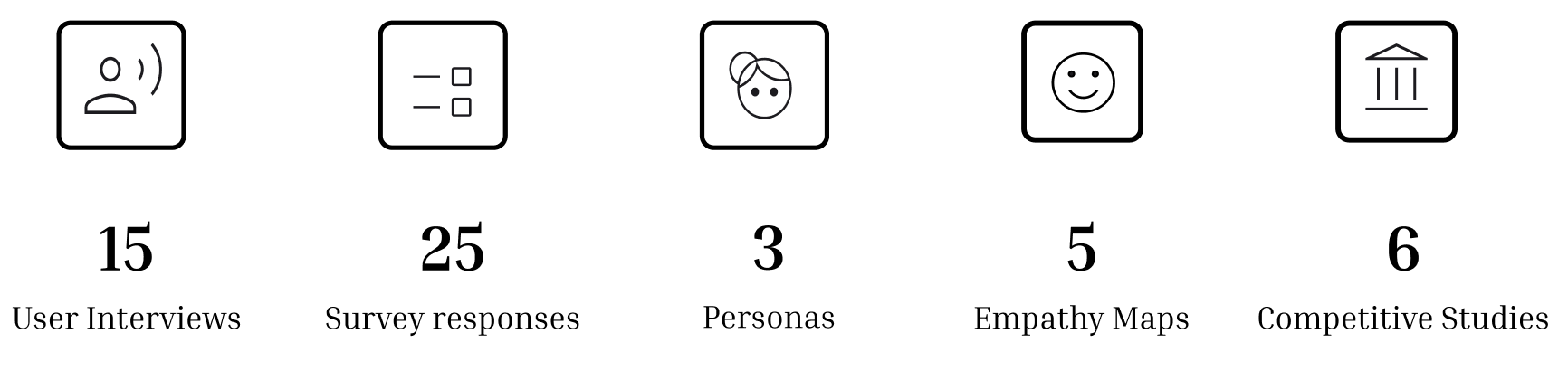

So I started doing research to gain a better understanding of what the target users need.

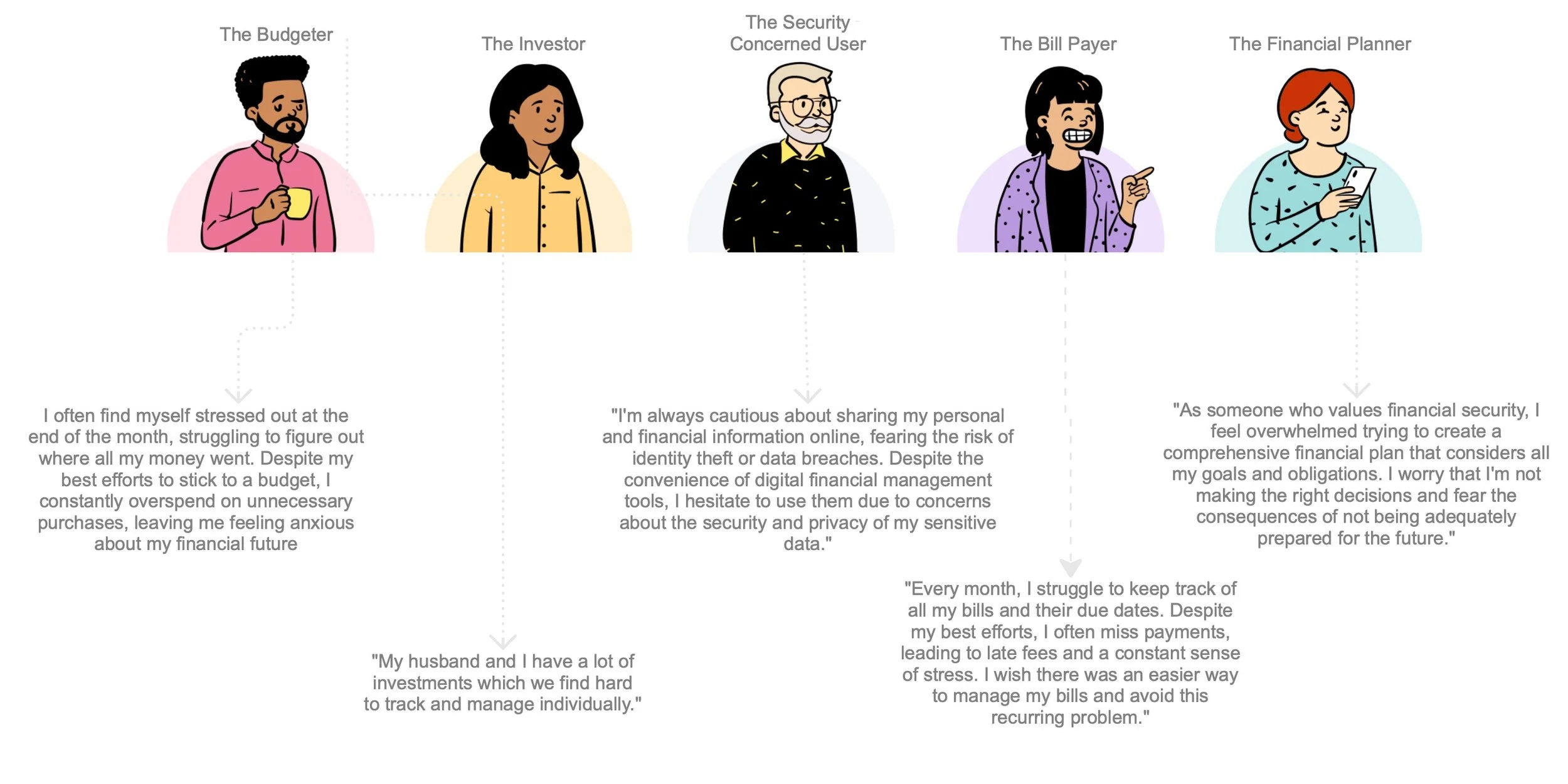

The users I interviewed highlighted several relatable pain points and frustrations which gave me a perspective beneficial in designing exactly for their needs.

I realized that financial management isn't just about numbers; it's about people.

It's about understanding their hopes, fears, and aspirations—and designing solutions that empower them to achieve their goals.

So I started designing with personas in mind.

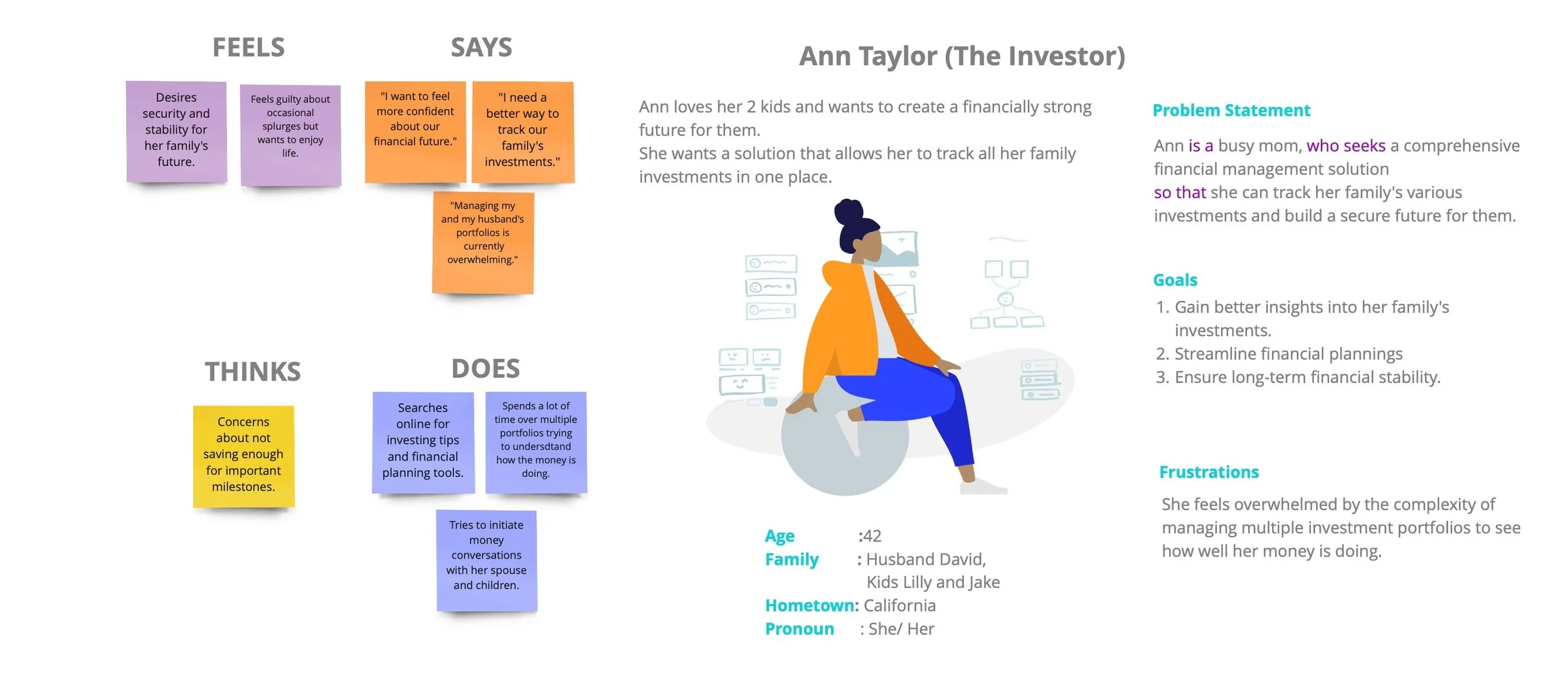

Empathy Map and Persona of Ann Tylor

Now it was time to do competitive analysis to see what other finance apps have to offer, what works well for them etc.

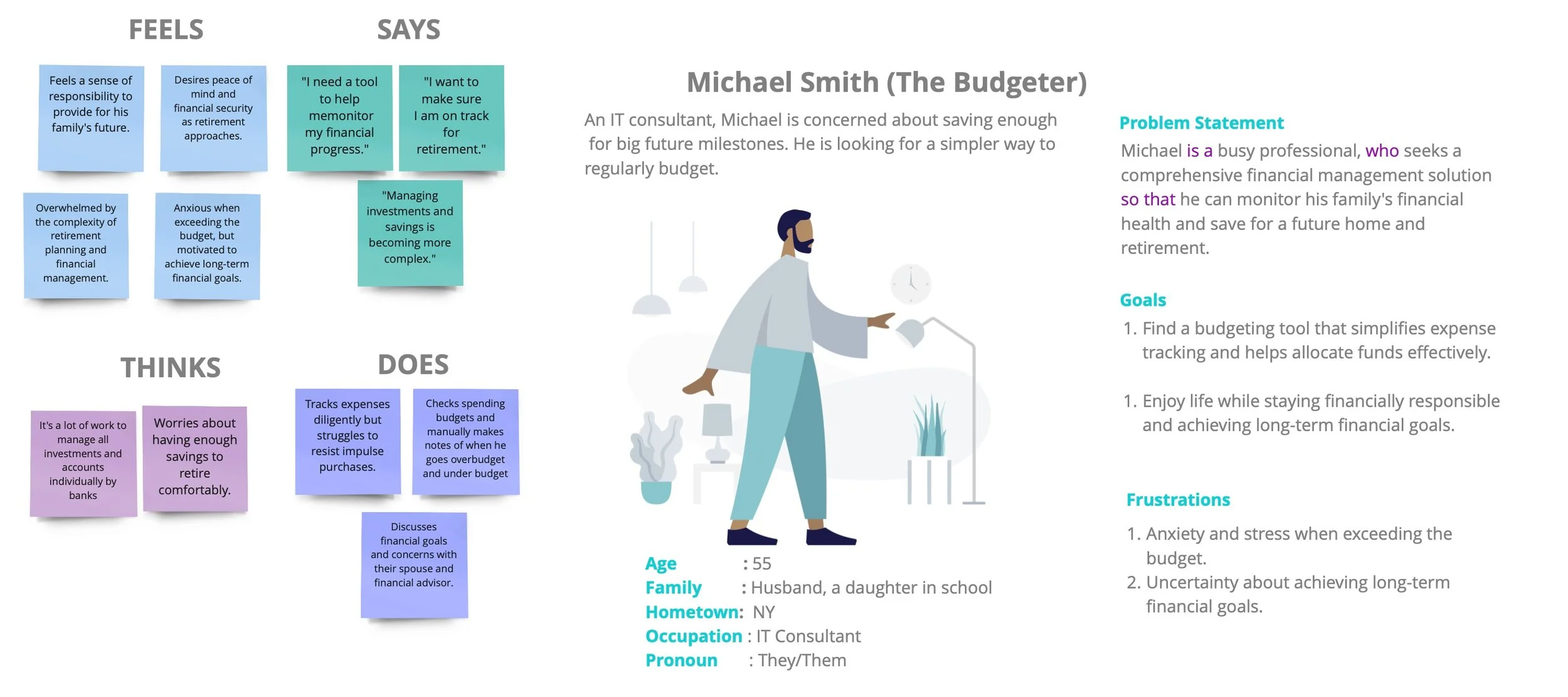

Empathy Map and Persona of Michael Smith

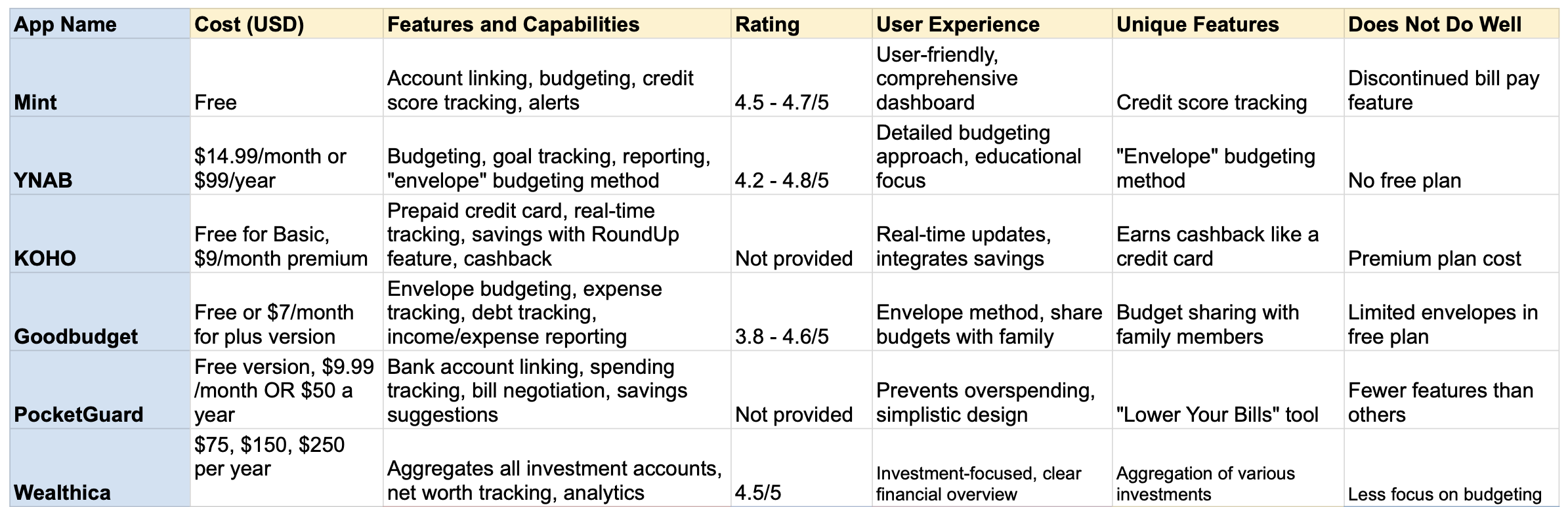

Cost: YNAB and Goodbudget offer premium services at a monthly or annual cost, while Mint and PocketGuard are free, and KOHO has both free and paid options.

Features and Capabilities: All apps provide budget tracking and account linking capabilities. YNAB emphasizes educational content and budgeting methods, while KOHO integrates a prepaid credit card with financial tracking.

Rating: YNAB has high ratings for its user interface and educational tools. Goodbudget's envelope system is well-liked, but its free version has limitations.

User Experience: Mint is noted for its user-friendly experience and comprehensive dashboard. YNAB is praised for its in-depth budgeting approach.

Unique Features: Mint offers credit score tracking, YNAB uses an envelope budgeting method, and KOHO allows users to earn cashback. Goodbudget allows for budget sharing with family members, and PocketGuard offers a tool to help lower bills.

Does Not Do Well: Mint has discontinued its bill pay feature, which was a downside for some users. YNAB lacks a free plan, which could be a barrier for some potential users. Goodbudget's free plan is limited in the number of envelopes, and PocketGuard may not have as many features compared to other apps.

Now that I understand the users’ needs, I feel ready to brainstorm some ideas to design an experience for a persona - Ann Taylor. Keeping personas in mind help me remember who I am solving for.

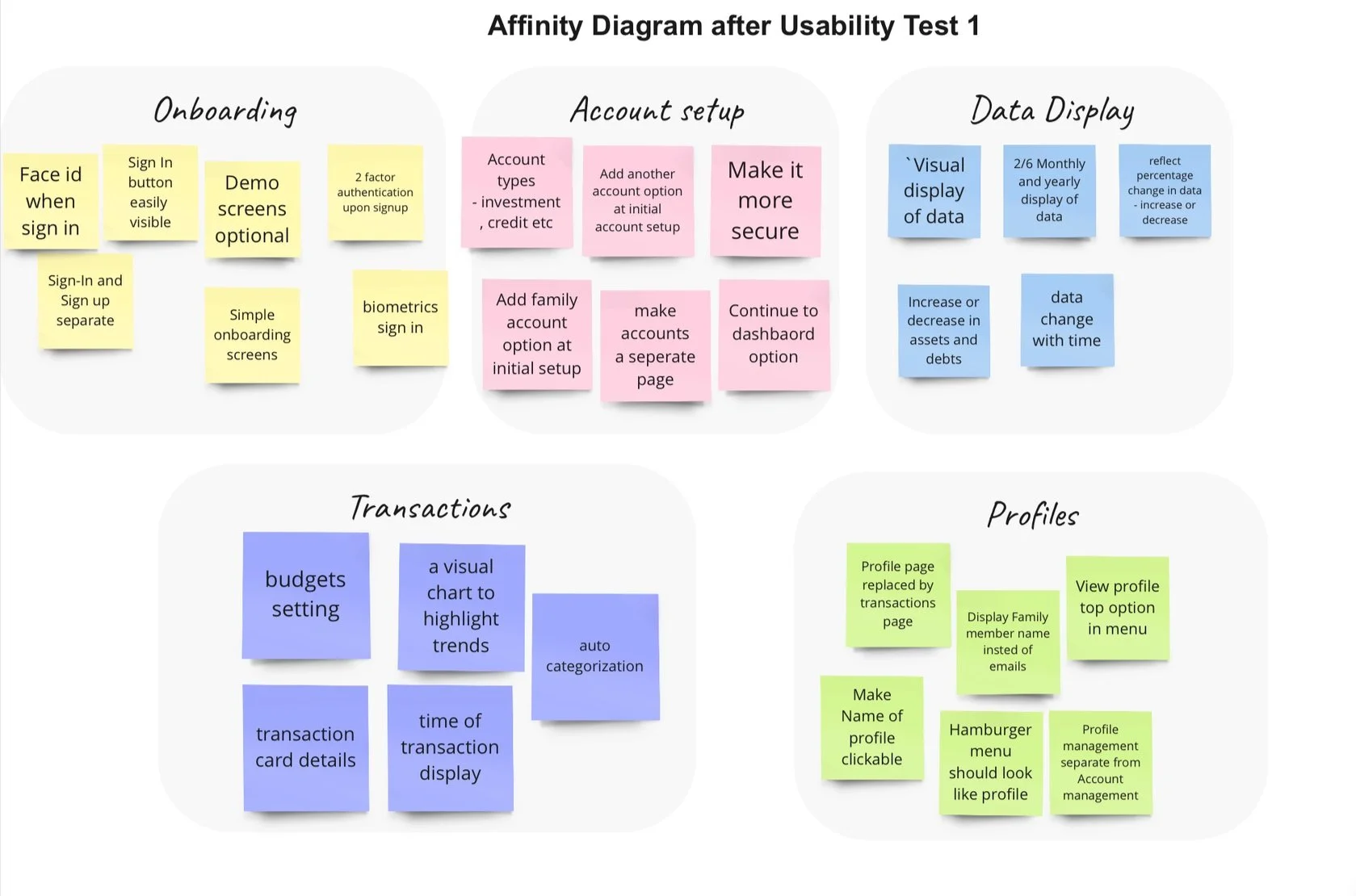

Now it’s time for a crucial step - Usability Testing - to have users interact with the designs to uncover potential issues, validate design decisions, and ensure the final product meets their needs and expectations

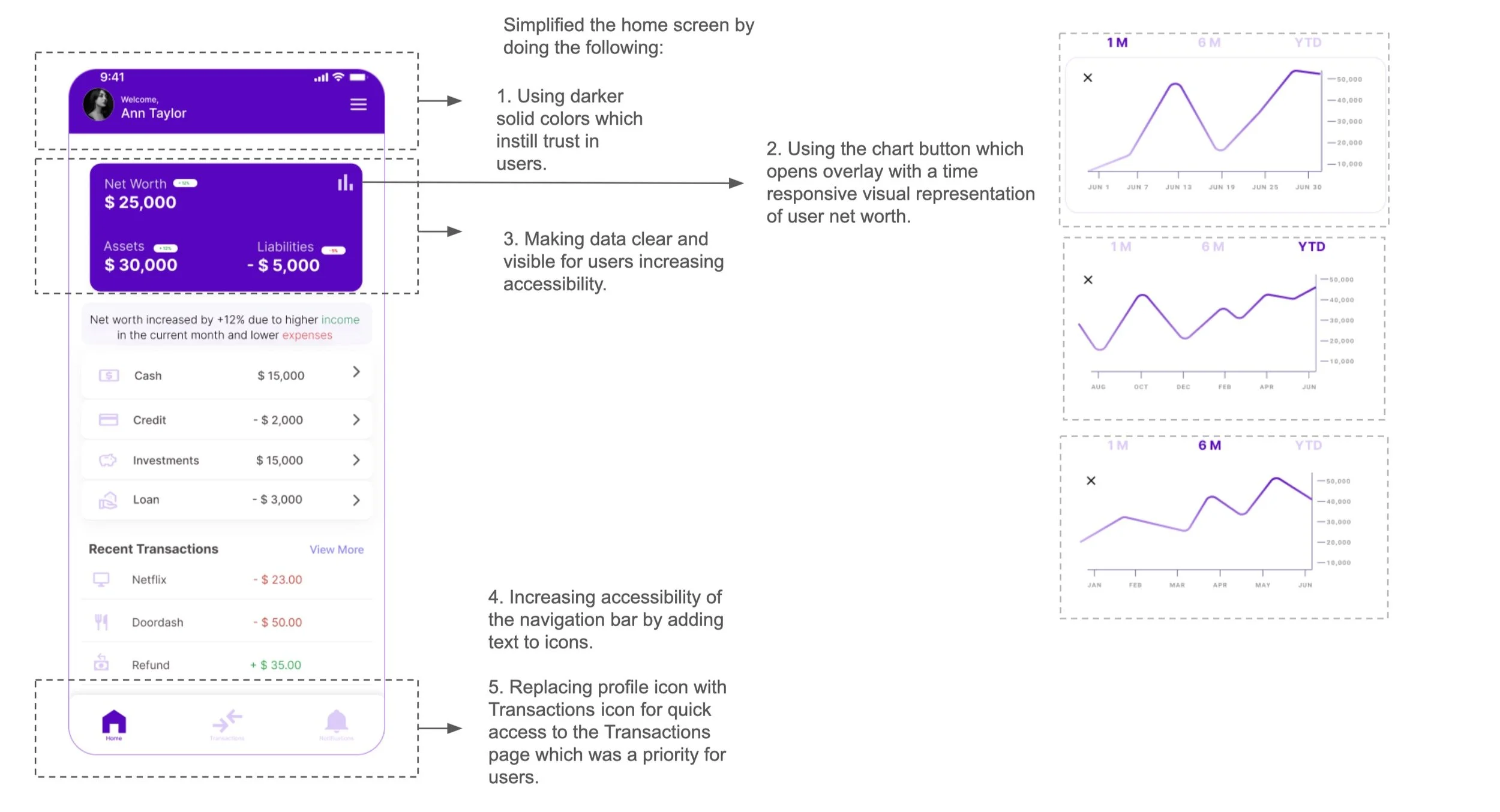

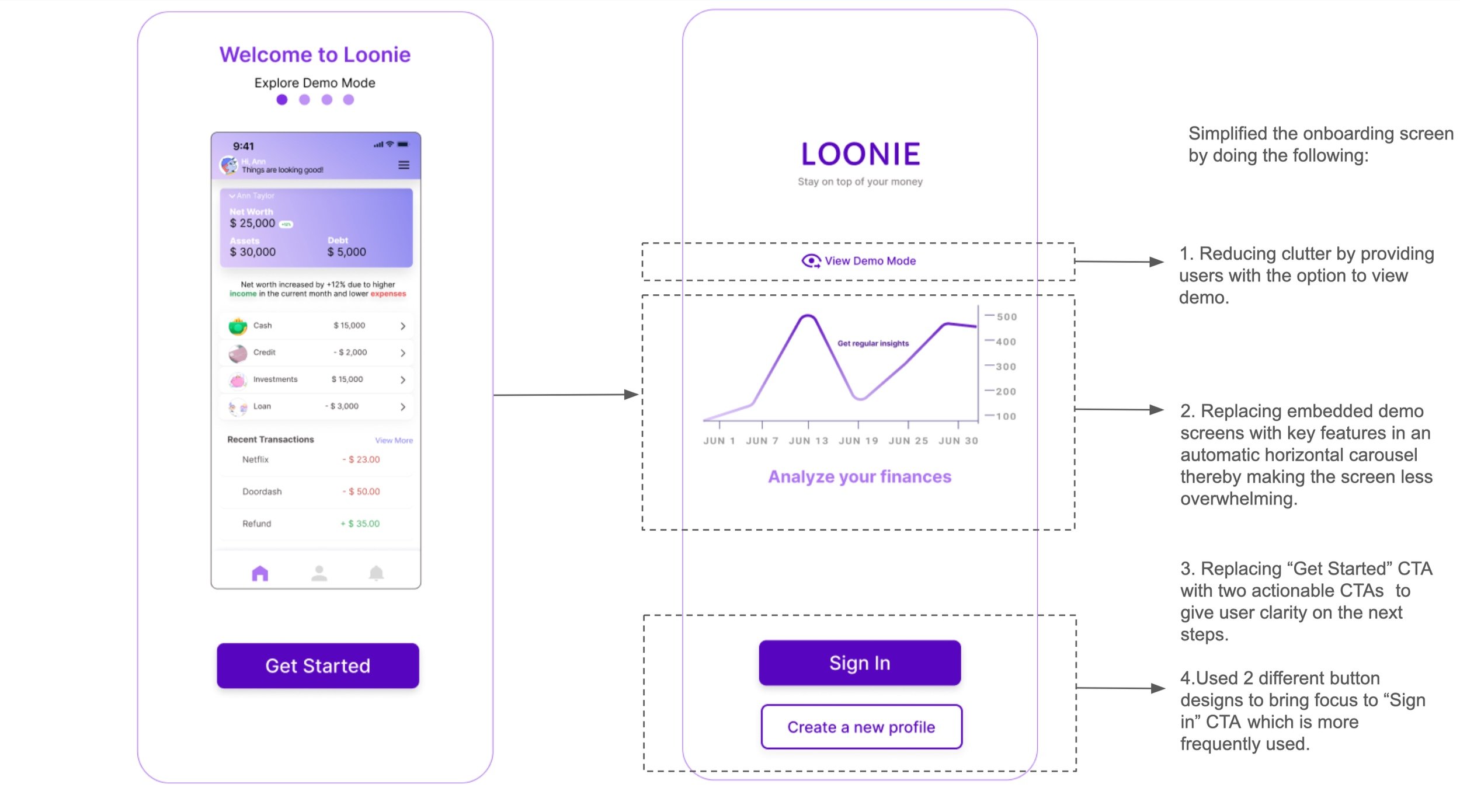

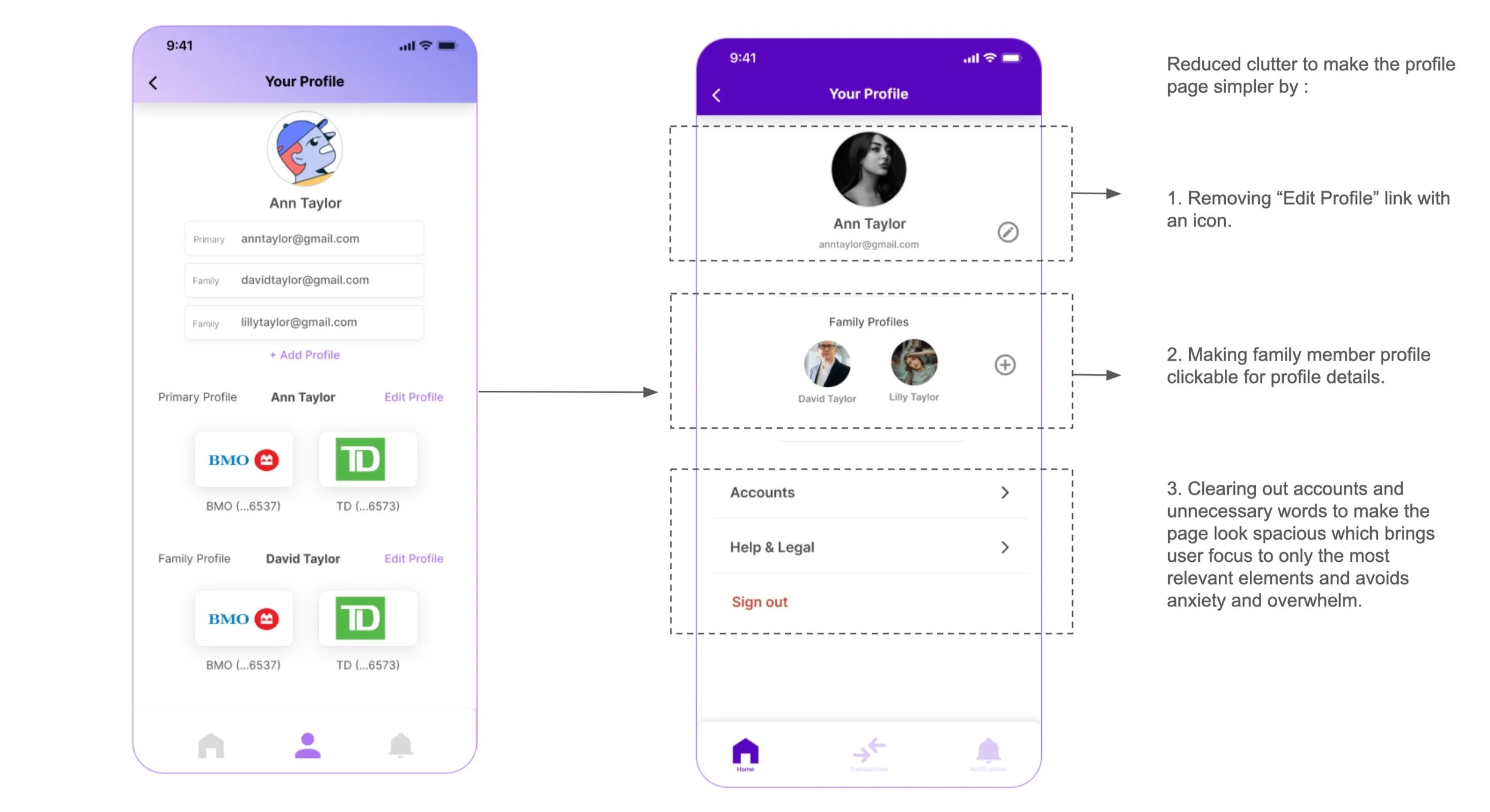

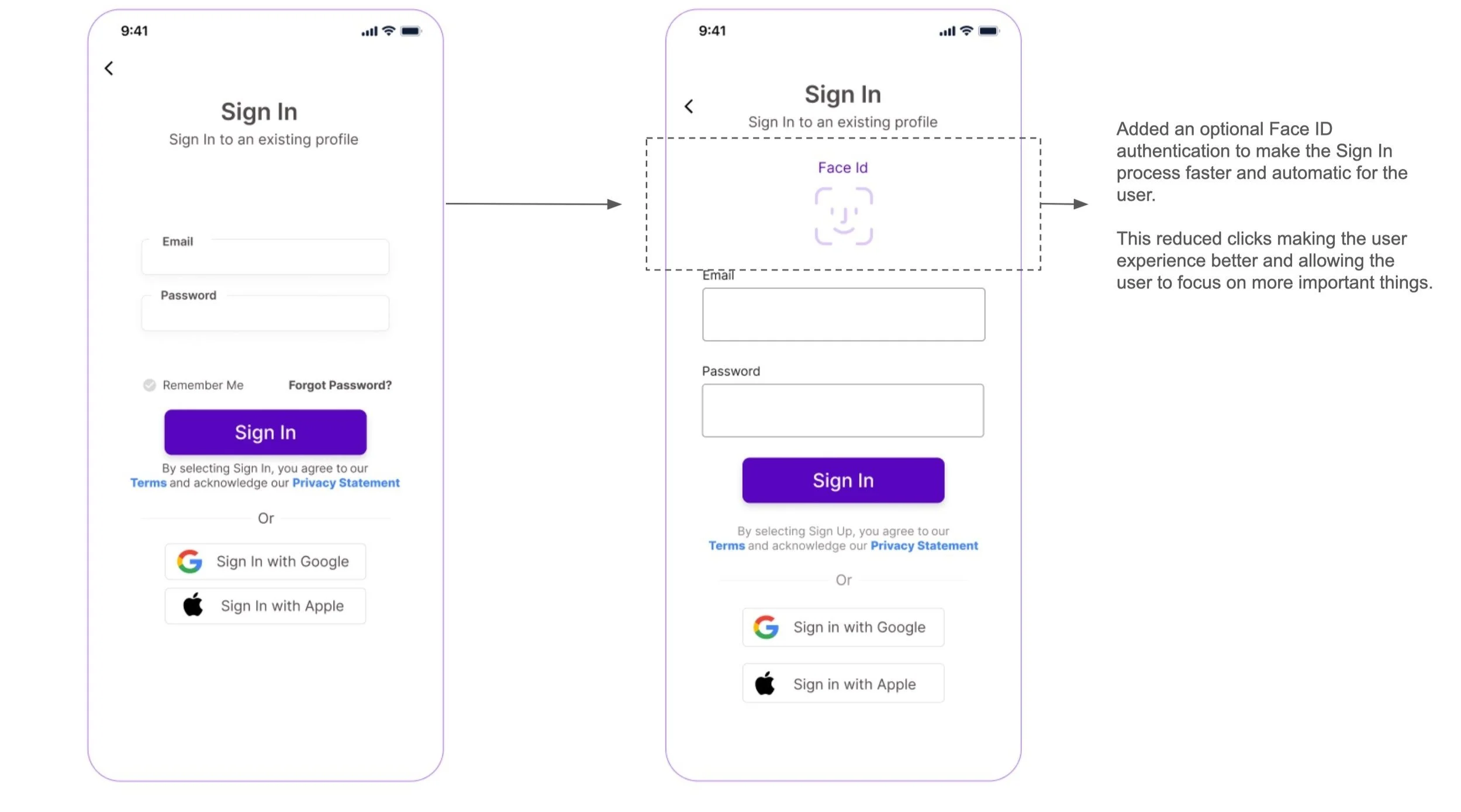

Here is the evolution of my designs based on insights created from the above user feedback

Insight 1

100% of users would prefer incorporating visual charts to highlight trends in net worth, making financial management more intuitive and engaging.

Insight 2 & 3

93% of users would like optional demo screens during initial setup, allowing them to tailor their onboarding experience based on their familiarity with the app.

66% of users want to keep sign-in and sign-up processes separate to streamline user flows and reduces confusion, ensuring a smooth onboarding experience.

Insight 4

73% of users would like to separate profile management from account management to simplify user interactions.

Insight 5

80% of users would prefer Face ID for sign-in for a seamless and secure authentication method, prioritizing user convenience and privacy.

Some of the challenges I faced during the design process.

Next Steps

Gauging product success and readiness to launch Phase 2 with advance functionalities based on some of the following metrics:

User Acquisition Rate

Active Users

Customer Engagement

Feature Adoption Rate

Customer Satisfaction Scores

Would be happy to discuss more over a chat!

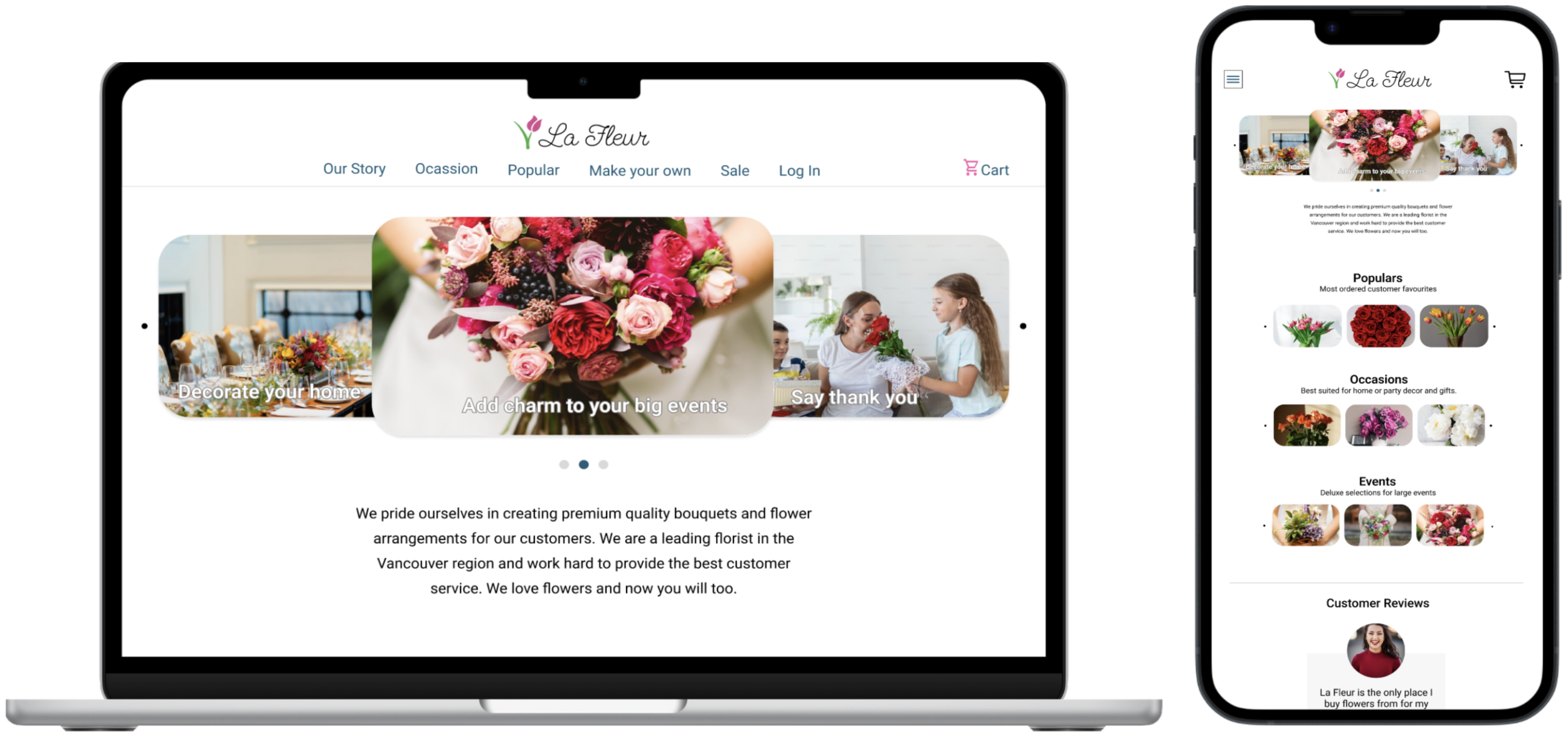

LA FLEUR

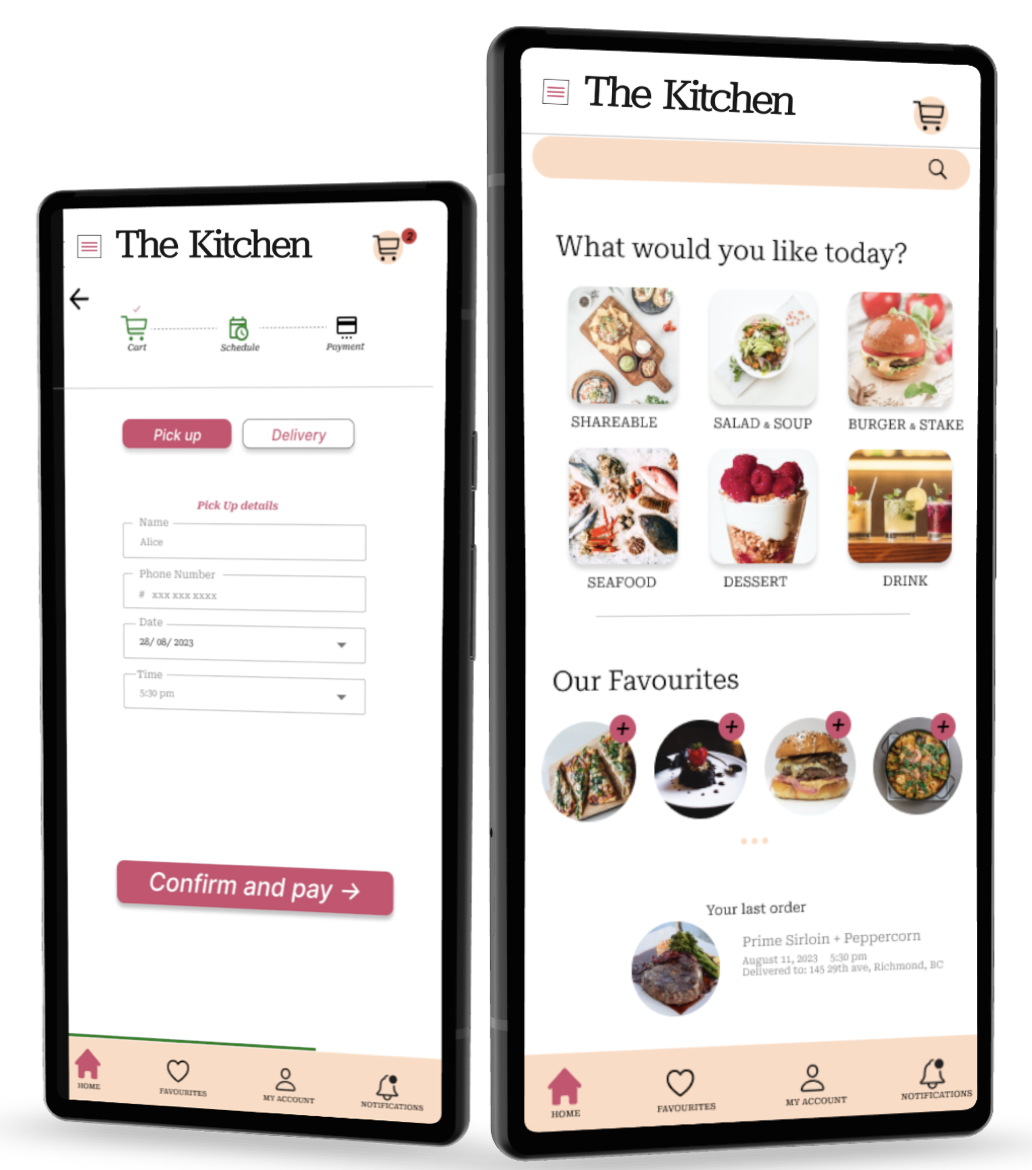

THE KITCHEN