MAKING PERSONAL FINANCE MANAGEMENT BETTER

THE PROBLEM

In 2023, US and Canadian families faced a lack of comprehensive, affordable, and user-friendly tools to manage their finances in one place. Existing solutions, like banking apps, spreadsheets, and standalone budgeting tools, were fragmented and often lacked key features such as investment tracking and personalized financial advice.

THE SOLUTION

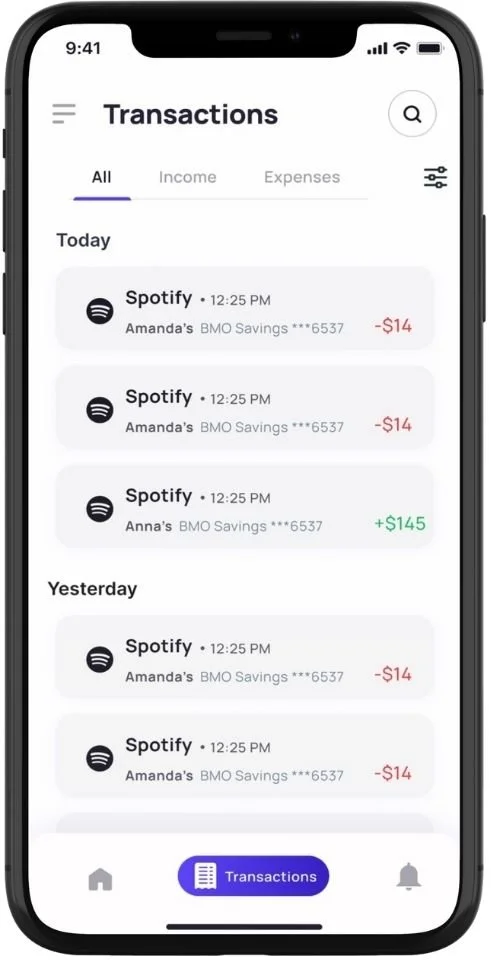

Shayr App was created to become an ultimate personal financial management mobile app targeted towards the Canadian and US market.

Seamlessly integrating all financial aspects into one secure and user-friendly mobile platform, Shayr offers comprehensive solutions for budgeting, investment tracking, and valuable financial insights, putting control of finances directly into the hands of our users.

MY ROLE

Founding Designer - User Research, Market Analysis,Ideating, Prototyping, Testing, Interation and everything in between.

Additionally, I frequently collaborated with the Founder/product manager and Engineering lead and conducted presentations with stakeholders.

RESEARCH

Financial management isn't just about numbers; it's about people. Only by understanding their hopes, fears, and aspirations—can we design solutions that empower them to achieve their goals.

UNDERSTANDING THE USER

Our Target users were looking for affordable ways to manage their family’s personal finances. This includes 20 - 70 year old US and Canadian residents who are budget-conscious, are managing multiple bank accounts and investment portfolios, and value financial planning and security.

The diverse perspectives of 15+ users highlighted several user needs and relatable pain points which helped me design exactly for their needs.

COMPETITIVE STUDY

The purpose of this study was to identify a market gap and learn what features are some competitive products offering. I personally tested core workflows across 6 mobile apps namely, Mint, YNAB, KOHO, Pocketguard, GoodBudget and Wealthica to understand existing consumer choices and behavior and to see if they’re already addressing all the user pain points.

Cost: YNAB and Goodbudget offer premium services at a monthly or annual cost, while Mint and PocketGuard are free, and KOHO has both free and paid options.

Features and Capabilities: All apps provide budget tracking and account linking capabilities. YNAB emphasizes educational content and budgeting methods, while KOHO integrates a prepaid credit card with financial tracking.

Rating: YNAB has high ratings for its user interface and educational tools. Goodbudget's envelope system is well-liked, but its free version has limitations.

User Experience: Mint is noted for its user-friendly experience and comprehensive dashboard. YNAB is praised for its in-depth budgeting approach.

Unique Features: Mint offers credit score tracking, YNAB uses an envelope budgeting method, and KOHO allows users to earn cashback. Goodbudget allows for budget sharing with family members, and PocketGuard offers a tool to help lower bills.

Does Not Do Well: Mint has discontinued its bill pay feature, which was a downside for some users. YNAB lacks a free plan, which could be a barrier for some potential users. Goodbudget's free plan is limited in the number of envelopes, and PocketGuard may not have as many features compared to other apps.

PRODUCT OPPORTUNITY

I identified key customer asks across 5 categories - cost, features and capabilities, user experience, ratings and unique features.

No single solution (Manual Tracking on Excel, Banking Apps, Standalone Budgeting Solutions) was meeting all feature requirements.

I identified (P0 and P1) priorities to focus our efforts:

P0: Account Aggregation at family level; Expense Tracking; Alerts for high spends; Security & Privacy

P1: Budgeting capabilities; bill reminders; credit score tracking; Financial Insights and recommendations

IDEATION

Using insights from user interviews, I generated ideas to solve key pain points and presented user journeys, storyboards, wireframes, and prototypes to stakeholders, fostering collaboration and driving solution-focused discussions

Now it’s time for a crucial step - Usability Testing - to have users interact with the designs to uncover potential issues, validate design decisions, and ensure the final product meets their needs and expectations

Some of the challenges I faced during the design process.

Happy to discuss more over a chat!